IRS 11379 2004-2025 free printable template

Show details

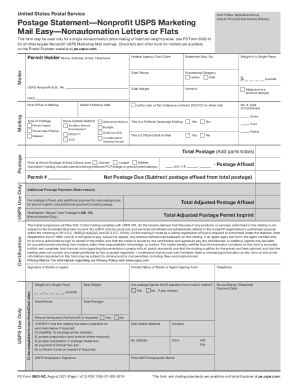

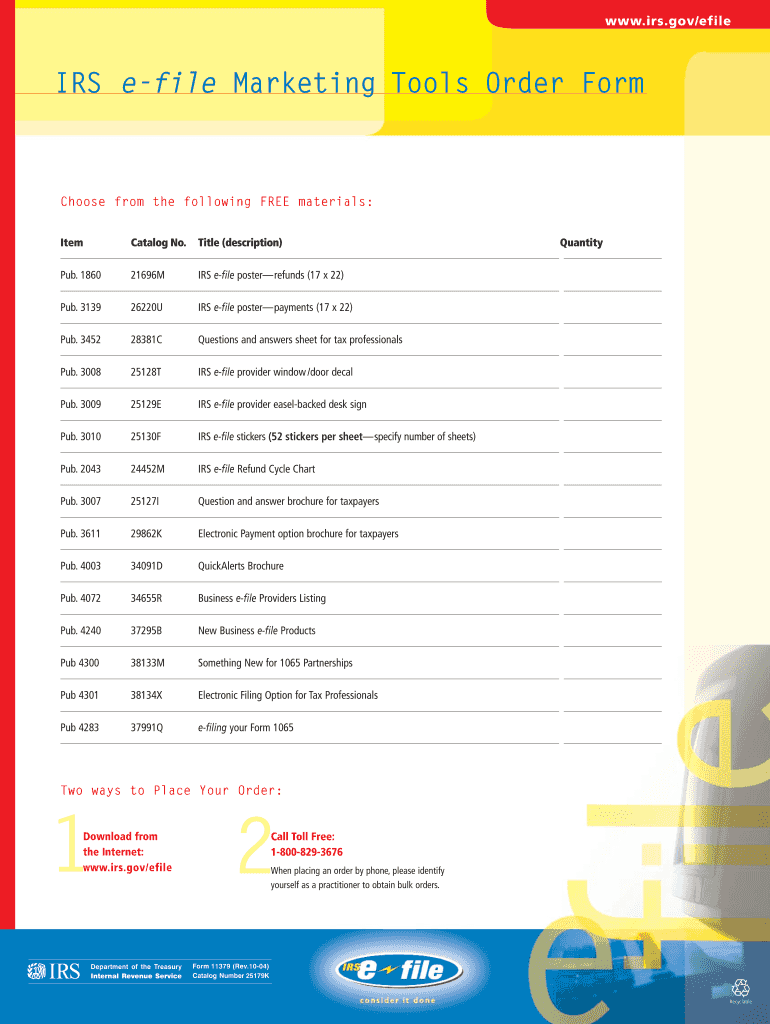

Www.irs.gov/efile IRS e-file Marketing Tools Order Form Choose from the following FREE materials Item Catalog No. Title description Pub. 2043 24452M IRS e-file Refund Cycle Chart 25127I Pub. 3611 29862K Electronic Payment option brochure for taxpayers Pub. 4003 34091D QuickAlerts Brochure Pub. 4072 34655R Business e-file Providers Listing Pub. 4240 37295B New Business e-file Products Pub 4300 38133M Something New for 1065 Partnerships 38134X Elec...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs tax forms online

Edit your irs fillable pdf forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs file forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs tax form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit irs forms. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fillable tax forms

How to fill out IRS 11379

01

Obtain the IRS Form 11379 from the IRS website or office.

02

Review the instructions accompanying the form carefully.

03

Fill out your personal information in the designated sections, including your name and address.

04

Provide detailed financial information as required by the form.

05

Attach any necessary supporting documents as indicated in the instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form.

08

Submit the form to the designated IRS address, either by mail or electronically if applicable.

Who needs IRS 11379?

01

Individuals or entities who are looking to resolve tax issues through the IRS Fresh Start Program.

02

Taxpayers seeking to make payment arrangements for their tax liabilities.

03

Those who are unable to pay their tax debts in full and need to request a payment plan.

Fill

income tax return form online

: Try Risk Free

People Also Ask about irs fillable forms

What is the simplest tax form to fill out?

The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form.

Can you fill out tax forms yourself?

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Choose the income tax form you need. Enter your tax information online. Electronically sign and file your return.

What are tax questions I should ask?

8 Questions to Ask Your Tax Advisor What Does Your Tax Preparation Process Look Like? How Can You Help Me With My Tax Goals? What Information Will You Need From Me to File My Taxes? What Can I Do Differently to Improve My Tax Situation? Based on My Situation, What Other Things Should I Try and Do This Year?

How do I get answers to tax questions?

Contact the IRS for questions about your tax return Visit the IRS contact page to find tools and resources that cover a variety of tax-related issues. Or phone the IRS to speak with a representative.

How do I fill out an income tax form?

0:56 11:47 How to Fill Out Form 1040 for 2022 | Taxes 2023 | Money Instructor YouTube Start of suggested clip End of suggested clip Finally you will determine your tax bill or refund. This will tell you whether you have already paidMoreFinally you will determine your tax bill or refund. This will tell you whether you have already paid any or all of your tax bill and whether you are eligible for a refund if you have overpaid.

How do I fill out my income tax?

How To Complete Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information and dependents. Step 2: Report Your Income. Step 3: Claim Your Deductions. Step 4: Calculate Your Tax. Step 5: Claim Tax Credits.

Fill out your IRS 11379 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Online Tax Forms is not the form you're looking for?Search for another form here.

Keywords relevant to irs tax forms

Related to irs fillable forms login

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.